ThinkMarkets is regulated by the FCA, FSCA, and ASIC in three different countries. Its commitment to providing top-notch security to its clients is expressed in the renewal of its $1 million insurance policy from Lloyd’s of London. ThinkMarkets have an overwhelming number of recent negative reviews on this site. But at the same time, there are positive reviews as well – giving ThinkMarkets a rating of 3.29 on FoxPeaceArmy. However, another user seems to disagree with the earlier one’s opinion and reassures traders that the broker is indeed genuine. When asked about the profit margins that can be achieved with ThinkMarkets, he is of the opinion that a trader’s trading strategy is what gets them high profits, not the broker they trade with.

not customer oriented

Furthermore, the broker has a range of trading instruments across various asset classes to choose from. Overall, ThinkMarkets stands out for its advanced technical analysis tools, competitive spreads, and award-winning 24/7 client support team. It is best suited for experienced traders who are comfortable navigating complex trading features and require access to a wide range of markets.

Platforms and Tools

- Yes, ThinkMarkets make a wide range of markets available including crypto, forex, and commodities.

- All content is researched, fact-checked, and edited by our research team and all ratings and rankings are based on the team’s in-depth product testing.

- The broker also provides access to more than 3,500 CFD shares and 352 ETFs to speculate on.

- A swap fee is a trader’s cost for holding an open position overnight because of changing interest rates.

- For all of our broker reviews, we research, validate, analyse and compare what we deem to be the most important factors to consider when choosing a broker.

In this section of the review, we’ll take a closer look at the broker’s Affiliate Program, VPS Hosting feature, and Trading Central partnership. One Reddit user seems to like the cheaper rates offered by ThinkMarkets and is also recommending others to go with this brokerage firm for cheaper rates. Most of the Reddit users were drawn in because of the low commission.

Get a 20% bonus on your 1st deposit

Islamic account holders will not be charged on any positions held for the first six days. Swap/Rollover fees are charged when you keep a position open overnight. They can either be incurred or earned by a holder of a forex contract, meaning that the swap fees can be either positive or negative.

Demo Account

These insights can help to empower today’s traders, assisting them with generating trade ideas, validating trading decisions and managing risk. The broker keeps client funds in segregated accounts with top-tier banks such as Barclays to ensure that they are not used for any other purposes such as operating costs. Whilst most brokers in the industry use a standard approach to protect clients, they take that extra step to ensure client safety. This helps to give clients additional peace of mind that they are using a trusted and reputable broker. The broker operates in a transparent manner with emphasis on looking after client’s own interests and safety. They are regulated by some of the most strict and respected regulatory bodies including the FCA and ASIC.

Do note that this commission only applies to trade involving FX and metals as outlined on its website. An ETF is a collection of assets (inclusive of stocks, commodities etcetera) packed into a single financial instrument that, just like a share, can be traded on an exchange. BetaShares FTSE 100 ETF, iShares S&P 500 ETF, and VanEck Vectors Small Companies Masters ETF are just a few examples of ETFs the broker offers on its platform. In addition to trading stock CFDs, Australians will be able to purchase and invest in any Australian stock of their choice via ThinkMarkets Australia.

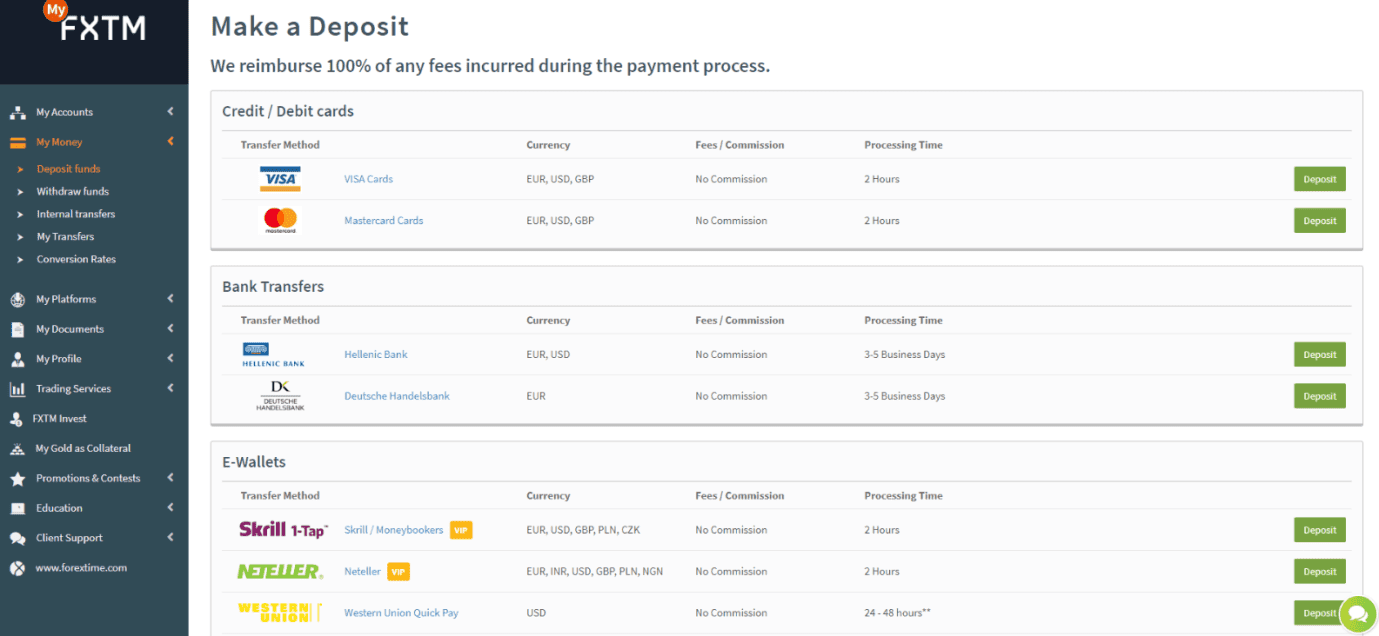

Fast, professional and friendly support

If you have modest means and plan to be opening smaller-sized positions more frequently, then you should better choose an account that does not have any fixed commissions per traded volume. In contrast, if you expect to be placing much larger orders less frequently, then you should be more preoccupied with finding an account with tighter spreads and be less concerned with fixed commissions. The broker does not charge deposits or withdrawals, though you might have to pay any third-party banking fees. For instance, international bank transfers cost $25 on a minimum withdrawal amount of $100. For general questions, such as how to open an account or how long it takes for a withdrawal request to clear, clients of ThinkMarkets can turn to the dedicated FAQ section of the website.

ThinkMarkets offers a variety of powerful and sophisticated trading platforms, including the user-friendly MetaTrader and ThinkTrader platforms, to meet the needs of various traders. You can trade with flexibility as desktop, web, and mobile platforms are all available. The mobile trading apps are beneficial if you need to access your trading account while on the go. In addition, the broker provides useful trading tools such as VPS service to run your automated trading strategies remotely.

The MT5 platform is the latest version of the popular MT4 software. It appeals to seasoned traders, in particular, offering more advanced trading tools and analysis features. Users benefit from additional technical indicators and timeframes, plus an enhanced strategy tester for EAs, as well as a built-in economic calendar. ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours.

Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators – ideal for complex forex strategies. They also provide demo accounts if you would like to test the different trading platforms and conditions before opening and funding thinkmarkets broker review a real account. I would always recommend trying a broker with a demo account at first. This way you can see if they can meet your personal needs as every trader is different. ThinkMarkets have a choice of trading accounts to suit different traders needs.

DayTrading.com is committed to helping traders of all levels make informed decisions about which broker to trade with. If you have traded with ThinkMarkets we would really like to know about your experience – please submit your own review. The multitude of tools are all designed to help traders boost revenue and minimise losses. The maximum leverage available depends upon the type of account (retail /professional) and the ThinkMarkets entity. MT4 offers 4 types of pending orders, whereas MT5 offers 6 types. ThinkMarkets usually processes withdrawal requests within 24 hours, though it may take between 1 and 7 business days for the funds to be transferred.

ThinkMarkets does not support social trading, though automated trading is available on MetaTrader via its Expert Advisors (EAs) feature. Another supporting tool incorporated by ThinkMarkets is Myfxbook (a social community platform for Forex https://forexbroker-listing.com/ traders), which is available to MT4 accounts with a minimum balance of $1000. Among other things, ThinkMarkets has built a highly intuitive and customizable platform that offers hundreds of technical indicators and drawing tools.

The average spread cost for the EUR/USD of 1.1 is slightly above the industry average of 1.08. In this section, ThinkMatkets provides guides for technical analysis. You can always put the principles that you have learnt into practice with a free demo account. The innovative TrendRisk Scanner will explore numerous assets and use risk management to give you real-time trading signals.

The layout is easy to navigate and the website did provide a lot of information. Actually I want to really complain about the poor quality and response of the servers of Think Markets. You stop loss are not taken into account you can also not update you stop loss during hight volatility the response of the servers is an issue. The last thing that happened to me is when I tried to scalp and completely lost access to the market once I could return my stop loss was hit. 📒 Provision is made for tutorials that cater to beginners, intermediate and advanced traders. Beginners can start at the very first step by learning how to start trading.

The broker does have a selection of trading tools that can be used to assist with your trading and to keep up to date with the latest market news. I do feel that the provided platforms should have more than enough tools for most traders to conduct in-depth market analysis. However, if you like to have more tools at your disposal, you won’t be disappointed. I am especially happy to see the addition of Trading Central and Autochartist. I feel these are two of the best tools for automated market analysis.

If you have experience trading with ThinkMarkets please share your personal review of the broker and what you think are strong and weak points. Demo accounts on MT4/MT5 will expire after 90 days of inactivity and demo accounts on the ThinkTrader platform do not expire but ThinkMarkets do reserve the right to close them. For security reasons, the withdrawal and deposit method must be the same.

+55 11 4228 6666

+55 11 4228 6666