There are bank-only transactions that your company’s accounting records most likely don’t account for. These transactions include interest income, bank deposits, and bank fees. If you use the accrual system of accounting, you might “debit” your cash account when you https://www.personal-accounting.org/what-type-of-business-bank-account-do-i-need/ finish a project and the client says “the cheque is going in the mail today, I promise! Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid).

Bank reconciliation statement:

These charge payments are usually not recorded in the bank’s customer records. It does not appear on the month-end bank statement and is not a reconciling item in the month-end reconciliation if it has not yet cleared the bank by the end of the month. Bank reconciliation also helps you identify fraud or theft and intervene early. If someone has withdrawn funds without your knowledge or consent, bank reconciliation will clue you in.

What is bank reconciliation? Definition, examples, and process Chaser

First, make sure that all of the deposits listed on your bank statement are recorded in your personal record. If not, add the missing deposits to your records and your total account balance. The goal of bank account reconciliation is to ensure your records align with the bank’s records. This is accomplished by scanning the two sets of records and looking for discrepancies. If you find any errors or omissions, determine what happened to cause the differences and work to fix them in your records.

Our Services

There are times when the bank may charge a fee for maintaining your account. Therefore, while preparing a bank reconciliation statement you must account for any fees deducted by the bank from your account. When you prepare the bank reconciliation statement for the month of November as on November 30, 2019, the cheque issued on November 30 is assets definition and types • examples of fixed assets unlikely to be cashed by the bank. You need to adjust the closing balance of your bank statement in order to showcase the correct amount of withdrawals or the cheques issued but not yet presented for payment. At times, your business entity may omit or record incorrect transactions for cheques issued, cheques deposited, the wrong total, etc.

However, as a business owner, it’s important to understand the reconciliation process. You should perform monthly bank reconciliations so you can better manage your cash flow and understand your true cash position. Read on to learn about bank reconciliations, use cases, and common errors to look for. One is making a note in your cash book (faster to do, but less detailed), and the other is to prepare a bank reconciliation statement (takes longer, but more detailed). For example, a restaurant or a busy retail store both process a lot of transactions and take in a lot of cash. They might reconcile on a daily basis to make sure everything matches and all cash receipts hit the bank account.

When the company pays the bill, it debits accounts payable and credits the cash account. Again, the left (debit) and right (credit) sides of the journal entry should agree, reconciling to zero. When you compare the transactions, you’ll notice that your records indicate payments from your clients, but your bank’s records don’t. As a result, bank account reconciliations confirm all of your receipts, allowing you to spot entries for receipts you didn’t deposit. Once you’re done comparing the accounts, reconciling any problems, and adjusting your bank and cash balances, there should be an unreconciled difference of $0 between your general ledger and bank statement.

Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available. Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. As mentioned above, the process of comparing your cash book details with the records of your business’ bank transactions as recorded by the bank is known as bank reconciliation. Now, while reconciling your books of accounts with the bank statements at the end of the accounting period, you might observe certain differences between bank statements and ledger accounts. An outstanding cheque refers to a cheque payment that has been recorded in the books of accounts of the issuing company. But, the cheque has not yet been cleared by the bank as a deduction from the company’s cash balance.

Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook. Therefore, it makes sense to first record these items in the cash book to determine the adjusted balance of the cash book. However, in the bank statement, such a balance is showcased as a debit balance and is known as the debit balance as per the passbook. Bank reconciliation statements safeguard against fraud in recording banking transactions. Additionally, bank reconciliation statements brings into focus errors and irregularities while dealing with the cash. Furthermore, they reflect the actual position in terms of bank balance.

- Generally speaking, bank reconciliations should be completed on a monthly basis to ensure accuracy and timely updates.

- To successfully complete your bank reconciliation, you’ll need your bank statements for the current and previous months as well as your company ledger.

- This document can help ensure that your bank account has a sufficient balance to cover company expenses.

- A bank reconciliation statement is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system.

- Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available.

In the long run, you should contact the payee to determine if they received the check; if they didn’t, you’ll have to invalidate it and issue them a new one. With reconciliation, on the other hand, https://www.kelleysbookkeeping.com/ you can correct errors by pointing them out after the fact. BR can uncover some types of fraud; this information can be utilized to develop improved controls over cash receipt and payment.

Otherwise, you’ll have to pursue the payee for the second check’s reimbursement. If you had the check canceled with the bank, the bank should reject it when you present it. In an ideal world, it would be best to perform reconciliation daily, using the bank’s month-to-date information, which should be available upon logging in to the bank’s website. You can discover and rectify problems quickly by doing a reconciliation every day.

However, in practice there exist differences between the two balances and we need to identify the underlying reasons for such differences. Your bank may collect interest and dividends on your behalf and credit such an amount to your bank account. It is important to note that it takes a few days for the bank to clear the cheques. This is especially common in cases where the cheque is deposited at a bank branch other than the one at which your account is maintained. Not Sufficient Funds (NSF) refers to a situation when your bank does not honour your cheque.

A fine will almost definitely be imposed by the bank on the company that issued the NSF check. A check that the bank of the entity issuing the check refused to honor because the entity’s bank account was insufficiently funded. If a bank account has very little activity such that it doesn’t need to be reconciled regularly, you should wonder why it exists at all.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Banks often record other decreases or increases to accounts and notify the depositor by mailed notices. We offer reconciliation reports, discrepancy identification, and live accountants to work with for ease and confidence when closing your books. They may not be fun, but when you do them on a regular basis you protect yourself from all kinds of pitfalls, like overdrawing money and becoming a victim of fraud. For a more detailed and thorough illustration of a bank reconciliation and to learn the related terminology, be sure to see our topic Bank Reconciliation. Mitch has more than a decade of experience as personal finance editor, writer and content strategist.

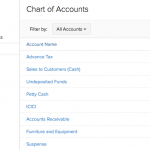

Cloud accounting software like Quickbooks makes preparing a reconciliation statement easy. Because your bank account gets integrated with your online accounting software, all your bank transactions get updated automatically. A bank reconciliation statement is a statement prepared by the entity as part of the reconciliation process’ which sets out the entries which have caused the difference between the two balances. It would, for example, list outstanding cheques (ie., issued cheques that have still not been presented at the bank for payment). In this step, you will compare your cash book and internal accounting records with those on the bank statement. Look for any differences in amounts, dates, or checks that have been written but may not appear on the bank statement.

To help with the transaction matching aspect of reconciliations, many firms use spreadsheet-based systems. When you add in the fact that you and your bank have different dates for numerous transactions, the reconciliation procedure becomes difficult. For starters, too many transactions will result in a long list of transactions to review.

+55 11 4228 6666

+55 11 4228 6666